defer capital gains tax australia

Tax rates on capital gains typically range from 15 to 20 percent. This is the difference between what it cost you and what you get when you sell or dispose of it.

The Capital Gains Tax Consequences Of Creating Rights Cordner Advisory Business Advisory Tax Accounting Based On The Gold Coast

The gain is deferred until December 31 2026or to the year when the taxpayer withdraws the QOF assets if that occurs earlier.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

. Lets say you purchased a single-family investment home for 100000. A Australia does not have any system where you can defer CGT by rolling the profit into another investment. For example a business can apply for an extension if it needs to replace a rollover asset and has not acquired the asset in the time allowed.

Although it is referred to as capital gains tax it is part of your income tax. You recently mentioned deferring a capital gains tax CGT liability. Particularly where settlement is deferred to a subsequent income year so there are no sale proceeds for the vendor to pay the tax or it is desired to set-off losses in the subsequent.

Skip to primary navigation. E the proceeds of disposition. Once upon a time you could have deferred capital gains taxes from the sale of that stock through use of a 1031 exchange.

Net capital gains are either taxable zero or equal to 0 for single and joint filed filings jointly as long as your taxable income is less than 40400 in both the same taxable year or the previous year. If you want to sell an investment property but dont need to cash out just yet you can defer paying capital gains taxes by doing a like-kind exchange. 0 for single and under 40400 and 80800 for married.

How to avoid capital gains tax in Australia 1. The investor is then exempt from income tax for that proportion of the income distributions they have received from the fund on a tax-deferred basis in the same financial year. 866 959-9969 415 656-8588.

Capital gains deferral B x D E where. As the investment is an untaxed gain the taxpayers initial basis in the QOF is zero. Now although you may have read Rich dad poor dad or a bunch of the Robert Kiyosaki books and while he does advocate reinvesting in order to save capital gains tax thats in America and as.

I set up a Self-Managed Super Fund SMSF to deposit the 250000 proceeds. It is not a separate tax. Lets call that Property A.

And 20 for more than 445851 for single filers. Theoretically these taxes could be deferred forever which well get to later. One year is the dividing line between having to pay short term versus long term capital gains tax.

15 for up to 445850 single and 501600 married. Long-term capital gains are the profits or gains earned on the sale of an asset you held for more than one year. By learning the tax exemptions and discounts youre eligible for you could lower your capital gains tax from investment property youve decided to sell.

For dispositions in 2021 report the total capital gain on lines 13199 and 13200 of Schedule 3 and the capital gains deferral on line 16100 of Schedule 3. You report capital gains and capital losses in your income tax return and pay tax on your capital gains. Paying taxes is an obligation but that doesnt mean you should pay more than you owe.

04 Aug 2021 QC 66018. The capital gains tax brackets are. In structuring 30 June transactions it is often desirable to sign a contract before 30 June but defer payment of capital gains tax CGT or the CGT event until a subsequent income year.

CGT is the tax that you pay on any capital gain. B the total capital gain from the original sale. Gains on the sale of collectibles are taxed at 28.

Australian Financial Complaints Authority 1800 931 678. If you have a capital gain it will. Short term capital gains are taxed as ordinary income.

For a gain to be deferrable it must be invested in a QOF within 180 days of the sale that resulted in the gain. On this page. However the Tax Cut and Jobs Act TCJA which took effect on Jan.

Here are five ways you can do this legally. If your business sells an asset such as property you usually make a capital gain or loss. Leaving Australia means capital gains tax can arise - CGT Event I1 - as there is a deemed disposal of investments at their market value.

This option allows me to defer paying the capital gains tax not avoid paying it altogether. 1 2018 eliminated personal property assets such as stamp collections art and yes your stocks from like-kind exchange treatment. Take Advantage of a Section 1031 Exchange.

D the lesser of E and the total cost of all replacement shares. Watch this quick 2-minute video to learn how you can defer your capital gains taxes for 30 years with a Tax-Deferred Cash Out. I delay my paying until I decide to withdraw that amount for my retirement or to push into an investment later on.

Well the answer to this question Deval is that from my knowledge you cant actually save capital gains tax by reinvesting it in another property. A 1031 exchange or like-kind exchange lets you defer taxes on the sale of an investment property by using the proceeds to buy another. Its not a separate tax just part of your income tax.

Of the investment for the purpose of calculating an investors Capital Gains. To defer taxation on income or gains relating to property which would otherwise be taxed in that State upon the individual ceasing to be a resident of that State for the purposes. There can be a big difference in the rate so it may make sense for some investors to wait at least one year before selling a property.

CGT does not apply if you owned the asset before CGT started on 20 September 1985. Timing capital gain or loss. Sometimes you can choose to roll over a capital gain.

Sell the Property After 1 Year. If you buy a house in 2019 and sell it in 2021 youve held it for. Capital gains tax CGT is the tax you pay on profits from selling assets such as property.

A Tax-deferred rate will be determined for each financial year eg. Fortunately the system does give you a 50 per cent discount on the tax payable if you. Here are some of the main strategies used to avoid paying CGT.

Current tax rates for long-term capital gains can be as low as 0 and top out at 20 depending on your income. Generally you make your choice in your tax return but you can apply for an extension of time. Here are some rules and key points to understand if youre an investor looking to sell property and avoid capital gains tax using this strategy.

Waterfront Carved Fish Chest Chest Of Drawers Grey Stain Elk Home

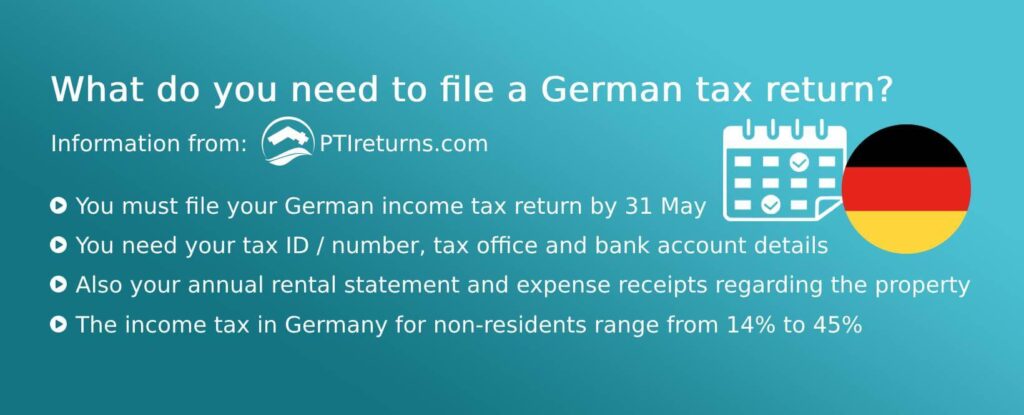

German Tax Advice For Smart Foreign Real Estate Investors Owners

Is There Capital Gains Tax On My Home Or Business Bishop Collins

Never Pay Taxes Again Using Rental Properties Rental Property Investment Real Estate Investing Rental Property Rental Property

Income Tax In Austria For Foreigners Academics Com

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

The 4 Things To Know About Capital Gains Tax On Sale Of Business Box Advisory Services

Capital Gains Tax On Shares Everything You Need To Know Box Advisory Services

Capital Gains Tax How It Affects Commercial Property Commercial Loans

Tax Minimisation Strategies For High Income Earners

Net Household Savings Rate In Selected Countries 2019 Savings Household Basic Concepts

Capital Gains Tax What Is It When Do You Pay It

Never Pay Taxes Again Using Rental Properties Rental Property Investment Real Estate Investing Rental Property Rental Property

Capital Gains Tax On Property Development Projects Developer Explains

German Tax Advice For Smart Foreign Real Estate Investors Owners

/taxes-word-on-wood-block-on-top-of-coins-stack-869670536-efbe1559282e4a5c87945445dd1b32a3.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)